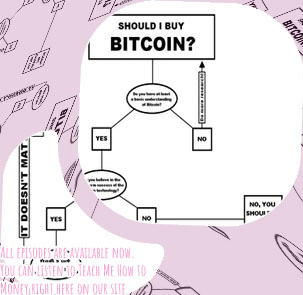

When considering whether or not to invest in Bitcoin, it is crucial to gather information and insights from reputable sources. Below are two articles that provide valuable analysis and perspectives on the topic of whether Bitcoin is a good buy or not. These articles will help readers make informed decisions about investing in this digital currency.

The Case for Investing in Bitcoin: Expert Opinions and Predictions

Bitcoin has been a hot topic in the world of finance and investing, with experts weighing in on whether it is a worthwhile investment. Many believe that Bitcoin has the potential to revolutionize the way we think about money and finance.

One of the key arguments in favor of investing in Bitcoin is its limited supply. Unlike traditional fiat currencies, which can be printed endlessly by governments, Bitcoin has a fixed supply cap of 21 million coins. This scarcity has led some experts to predict that the value of Bitcoin will continue to rise as demand increases.

Another factor driving interest in Bitcoin is its decentralized nature. Bitcoin operates on a peer-to-peer network, meaning that transactions are verified by users rather than a central authority. This has led some investors to view Bitcoin as a hedge against inflation and government interference in the financial system.

Despite these bullish arguments, there are also risks associated with investing in Bitcoin. The cryptocurrency market is notoriously volatile, with prices subject to sudden and dramatic swings. Additionally, Bitcoin has been criticized for its use in illegal activities and its potential to be hacked.

In conclusion, the case for investing in Bitcoin is a complex one. While some experts believe that Bitcoin has the potential to revolutionize finance, others caution that it is a risky and speculative investment. As with any investment,

Factors to Consider Before Buying Bitcoin: A Comprehensive Guide

Bitcoin has gained immense popularity in recent years, with many people looking to invest in this digital currency. However, before jumping into the world of Bitcoin, there are several important factors that one must consider.

One of the key factors to consider before buying Bitcoin is understanding the volatility of the market. Bitcoin prices can fluctuate dramatically in a short period of time, making it a high-risk investment. It is important to be prepared for this volatility and only invest money that you can afford to lose.

Another important factor to consider is security. As a digital currency, Bitcoin is susceptible to hacking and theft. It is crucial to take steps to secure your Bitcoin holdings, such as using a secure wallet and enabling two-factor authentication.

Additionally, it is essential to research and understand the regulatory environment surrounding Bitcoin. Different countries have varying regulations regarding the use and trading of Bitcoin, and it is important to ensure that you are compliant with these regulations.

Furthermore, it is advisable to diversify your investment portfolio and not put all your money into Bitcoin. Diversification can help mitigate risk and protect your investments in case of market downturns.

In conclusion, before buying Bitcoin, it is important to consider factors such as market volatility, security, regulatory environment, and diversification. By taking these factors into account